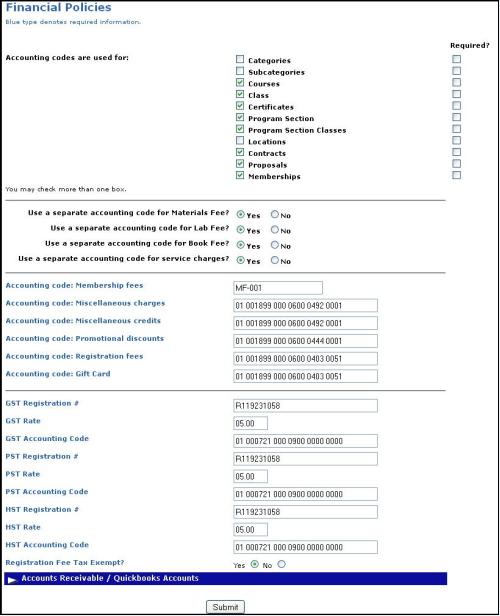

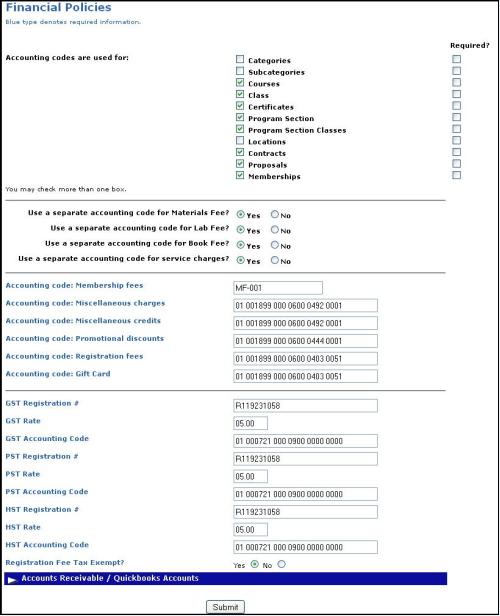

SYSTEM OPTIONS | Financial Policies |

The Financial Policies screen allows you to control how your Lumens system tracks and displays accounting and financial information in financial and analysis reports. This functionality is available to all Lumens Pro and Lumens Workforce customers. The Financial Policies screen also lets you create a set of accounting codes, which are used to display breakdowns of financial data. These accounting codes are used to gather transaction data for the Transaction Journal, Accounting Code and Revenue reports.

Click SYSTEM OPTIONS, financial policies.

After selecting the appropriate options and making the required changes, click Submit.

The screen will display the message Financial Policies have been updated.

|

In the Financial Policies screen you can set your financial policies to allow accounting codes at the category level, the subcategory level, the course level, the class level, and the location level (or all five). Once you have entered the Financial Policies settings, an 'Accounting code for class fee' text box displays on each add/edit page for those levels that you have chosen to allow accounting codes, category, subcategory, course, class, or location. All accounting codes must be 25 characters or less. Numbers, letters, and dashes are all acceptable.