![]()

Note:

The Credit Memo Template needs to be created before a credit memo can be issued. See Financial Management, Credit Memo Templates for instructions.

FINANCIAL MANAGEMENT | A/R Management |

Credit memos are created when an institution has obtained an overage of funds and uses a credit memo to return a portion of funds back to a company. A credit memo process is easier than creating a check request and having a check mailed to the company. Credit memos replace the constant need for issuing checks especially when large amount of transactions are feeding back and forth within an accounting system. A company usually has a balance or a continuum of financial exchanges where a credit memo adds to the efficiency of exchanging money.

|

|

Note: |

The Credit Memo Template needs to be created before a credit memo can be issued. See Financial Management, Credit Memo Templates for instructions. |

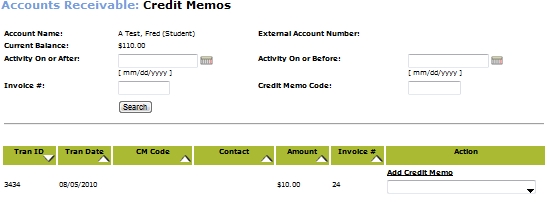

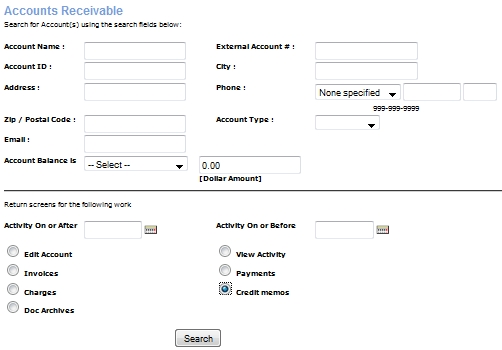

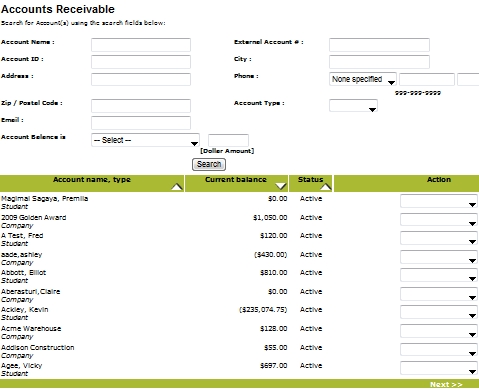

To start the process, you will need to locate the receiver for which the credit memo is allocated to and this can be done in a couple of ways.

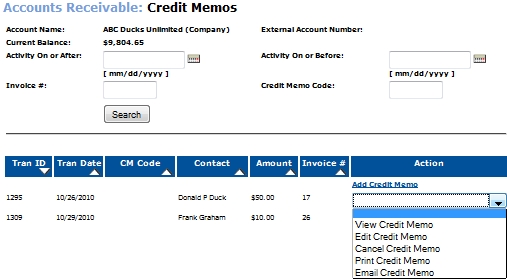

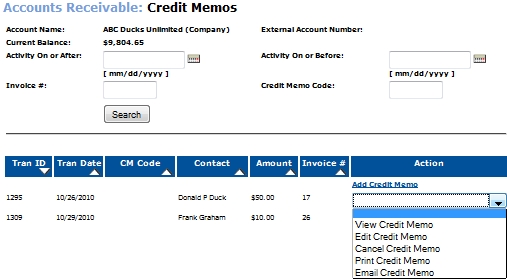

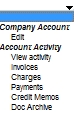

Choose the company and the action type from the drop-down list. Only if a credit memo exists will the drop-down actions will appear.

Click View Credit Memo. The Credit Memo template will appear.

There is more than one way to add a credit memo. Following the steps for the existing credit memo will give you the Add Credit Memo option on the company Accounts Receivable: Credit Memo screen.

Use the Next action link to find the name. (this process will take longer)

The Credit Memo process starts at the Accounts Receivable Credit Memo screen similar to the one below.

Each way will bring you to this screen.

Click Add Credit Memo.

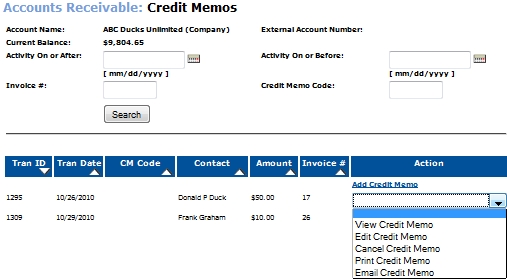

Fill in the Blue sections.

Click Continue.

|

|

|

Note: An Invoice has to be issued before a credit can be made. An invoice number is used to reference the credit.

|

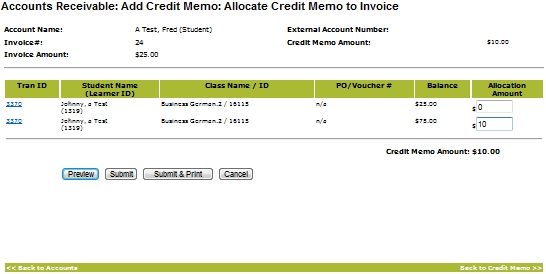

The screen to follow is the Add Credit Memo: Allocate Credit Memo to Invoice. A list of classes and the students who are enrolled will be given. In the field Allocation Amount apply the credit funds. You can choose to break down the credit amount and allocate them to each class or allocated the total amount to one class. Lumens allows for that flexibility and the choice is yours as how you want to appropriate the funds.

Click Preview - to see the document before submitting into final process.

Click Submit - to complete the credit memo process.

Click Submit & Print - to have a paper copy for your records.

Click Cancel - to escape or undo the application of the credit memo.

The Save Credit Memo document screen will appear and allows you a chance to change the file name and then click Submit.

Once the Submit button is clicked, confirmation of the transaction will appear in the Accounts Receivable:Credit Memos screen.