![]()

Note: To adjust or edit Instructor payments go to INSTRUCTOR, Instructor Profile.

REPORTS | Financial Analysis Reports |

DEFINITION: Instructor Payment displays instructor payment information and status. This report is a communication tool ONLY and NOT used as a payroll module or meant to be used to calculate what an instructor should be paid. This report should NOT be used for tax reporting.

HIGHLY RECOMMENDED TO USE REPORT IN THIS REGARD

|

|

|

Note: To adjust or edit Instructor payments go to INSTRUCTOR, Instructor Profile.

|

Click Run Report and a detailed report will appear.

To explain the report, it is displayed in four parts:

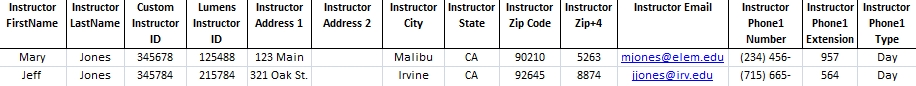

1 - displays information about the instructor

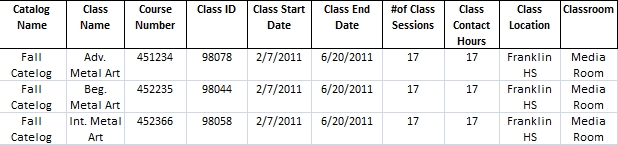

2- displays information about the class.

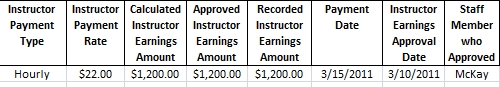

3 - displays information about the class fees and expenses.

4 - displays information about instructor earnings and payment.

Gross Tuition Fee – It is the original tuition of the class. It is the number for the tuition of the class WITHOUT any other fees or discounts included.

Class Costs includes fees not Material – is the class tuition includes other fees such as lab fee, insurance fee, building fee, book fee, etc. but does NOT include material fees.

Class Costs & Material Fees – is the total sum of the two fields Class Costs includes fees not Material and Material Fee.

Material Fees Collected in Advanced – This field is a yes/no indicator.

When the indicator is No = The Class Receipt field will NOT include material fees in the total.

When the indicator is Yes = The Class Receipt field will include material fees in the total.

Class Registration Payment – Class Registration Payment is the sum of all fees collected (Net of Discount) minus promotions, minus discounts, and minus miscellaneous credits.

Admin Fee – LERN’s recommends 30% for Admin costs.

Community Ed. Proceeds – is Class Receipts minus recorded instructor pay.